AI Gold Rush: Venture Capitalists Chase Sky-high Returns Amid Concerns Over Humanity's Future

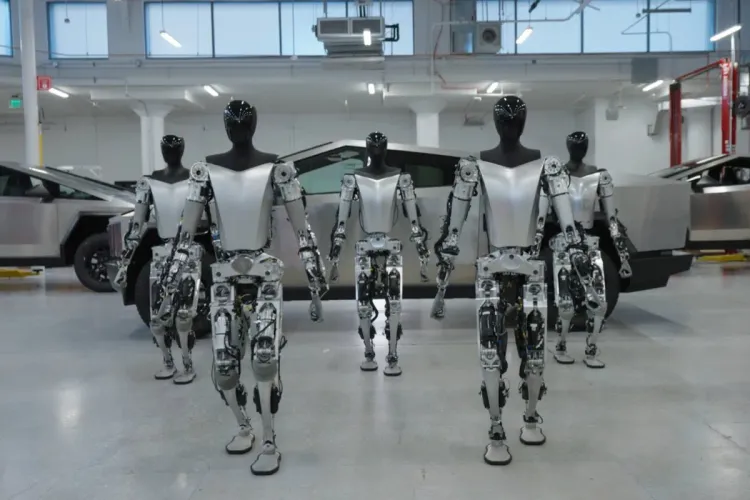

Drawing parallels to the invention of the atomic bomb, Warren Buffett has signified the potential and peril of artificial intelligence (AI). Echoing this sentiment, the venture capital world is in a frenzy, chasing after the next AI breakthrough amid soaring startup valuations.

OpenAI's ChatGPT, the fastest-growing internet application in history, has become a beacon for venture capitalists hunting for emerging AI stars. Despite an ongoing tech downturn, AI startups have proven to be an exception, bagging significant funding even without substantial public revenues.

This race has fueled valuation inflation, with startups showing scant progress scoring large funding rounds. The case of Anthropic, a U.S. firm working on a self-teaching AI algorithm, is illustrative. Despite being in its early stages, the firm has secured $450 million in funding at a rumored $4.1 billion valuation.

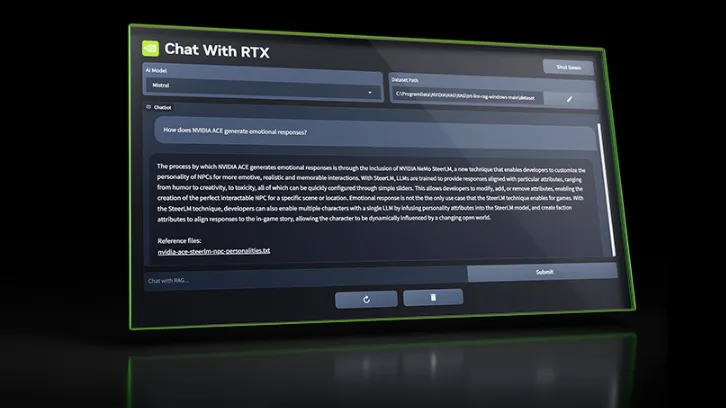

European startups are also witnessing this boom. French startup Mistral, founded by former Google DeepMind and Meta scientists, is rumored to be in talks for significant funding, even as details about the company remain scarce. The hope is for Mistral to become Europe's answer to OpenAI.

Despite an overall tech funding slump, AI investments remain robust. Startups secured $24.9 billion in Q1 2023, up from $23.4 billion year-on-year. As AI continues to draw massive investments, concerns about its potential dangers surface. Geoffrey Hinton, a leading figure in the field, has warned about the risks AI might pose to humanity.

David Grimm, a partner at AlbionVC, echoed these sentiments, "No one wants to invest in AI that's going to wipe out humanity." Investors are thus faced with the precarious balance of pursuing lucrative innovation and safeguarding the future of humanity.

Member discussion